MERGER AND AMALGAMATIONS

Mergers and Amalgamations have become attraction to entrepreneur, with the passage of time more and more enterprises are opting for mergers and acquisitions with an objective to reduce the cost of production and to make prices competitive.

Mergers, however, play a vital role in the external growth and expansion of leading companies all over the world and their major publicity is because of the increased and enhanced competition, breaking of trade difficulties, globalisation of businesses and facilitating free flow of capital across different countries. There are many ways for an entrepreneur to expand and grow its enterprise.

Due to the effect, the firms gradually grow in the routine course of business by replacing old and technologically old equipments, inclusion or acquisition of new assets overtime.

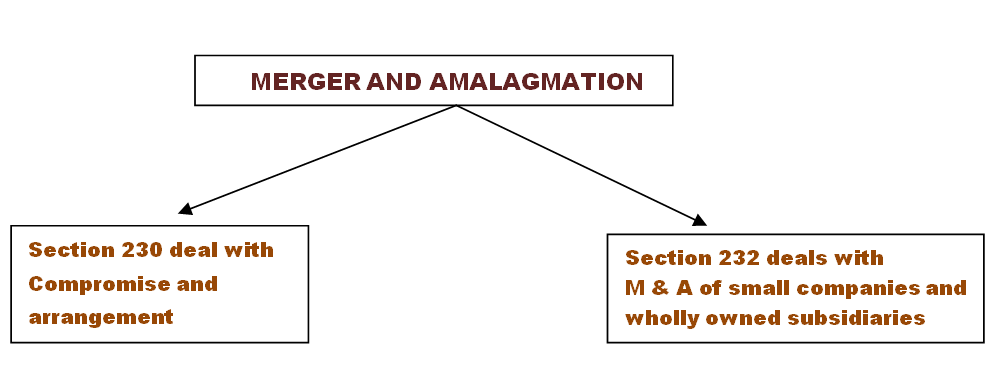

Under the Companies Act, 2013, the concept of Merger and Amalgamation has been fully explained whereas under the Companies Act, 1956 and Income Tax Act, 1961, the term “merger” was not been defined.

“Merger” means an arrangement whereby one or more existing companies merge their identity into another existing company. Any proposal and application for a merger or amalgamation begin with the process of due diligence, an essential step in carrying out the hole merger or amalgamation.

FAST TRACK MERGER

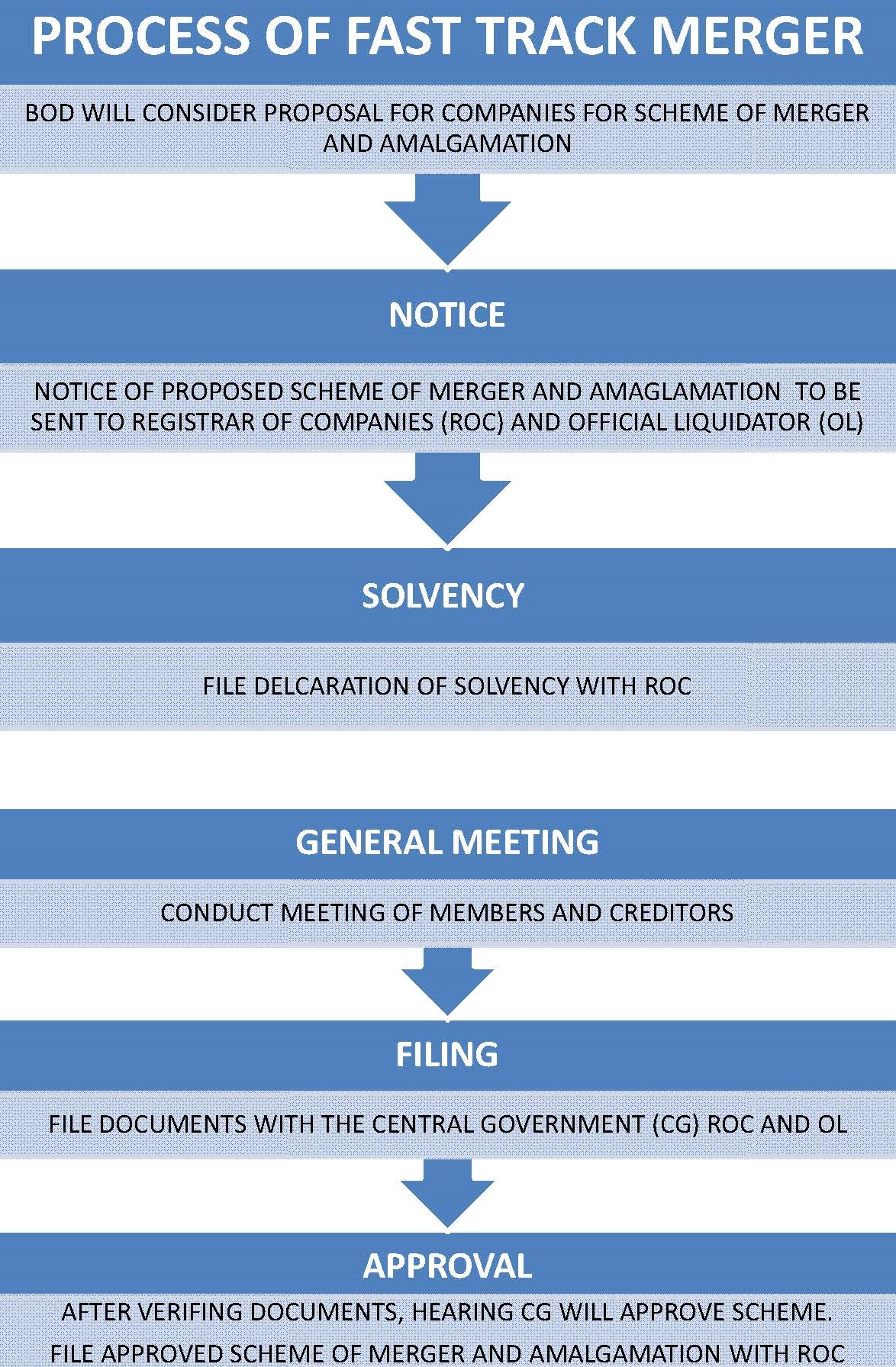

The Companies Act, 2013 has introduced the concept of ‘Fast Track Merger’ (FTM) for Small Companies and merger of Holding companies with its wholly owned Subsidiary Companies.

Notwithstanding the provisions of section 230 and section 232, a scheme of merger or amalgamation may be entered into between two or more small companies or between a holding company and its wholly owned subsidiary company or such other class or classes of companies as may be prescribed.

Section 233 of the Companies Act, 2013 dispenses with the cumbersome and time consuming process for mergers and lays down a simple, fast track merger procedure for the merger of certain companies like holding and subsidiary companies, and small companies.

Small Company [Section 2(85) of Companies Act, 2013]

“Small Company” means a company, other than a public company,—

- Paid-up share capital of which does not exceed 50 lakh or such higher amount as may be prescribed which shall not be more than Rs. 10 Crore; or

- Turnover of which, as per profit and loss account for the immediately preceding financial year, does not exceed 2 Crore or such higher amount as may be prescribed which shall not be more than Rs. 100 Crore:

- A holding company or a subsidiary company

- A company registered under section 8; or

- A company or body corporate governed by any special Act;

Preliminary Steps before Fast Track Merger

Check whether each Transferor and Transferee Companies Article of Association permits for mergers and amalgamation. If not, then alter AOA first.

Appoint at least 2 valuers for valuation of shares of each Transferor and Transferee Companies. (Not Mandatory Requirement)

Prepare draft scheme of merger, exchange ratio based on valuation

|

REASON OF M&A ·Optimum Economic Benefit ·De-risking Strategy · Scaling up of operation for competitive advantages ·Increase the Market capitalization · Cost reduction by reducing overheads · Increasing the efficiencies of operations · Tax benefits · Access foreign markets |

TERMS Amalgamation means combination of two or more independent business corporations into a single enterprise Demerger means transfer and vesting of an undertaking of a company into another company Reconstruction- means re-organization of share capital in any manner; varying the rights of shareholders and/or creditors Arrangement- All modes of reorganizing the share capital, including interference with preferential and other special rights attached to shares |

REVIVAL OF STRUCK OFF COMPANY

As all ROC’s has issued show cause notices to the Companies fallen u/s 248(1) (c). In notice ROC mentioned that it can strike off the Company if appropriate reply not filed within 30 days and ROC will take appropriate action against the Directors.

After that at the end of the June, 2017 ROC has struck off the 100,000 (One Lakh) Companies from its record. List of Companies struck off from record of ROC available at below given link. Even Our Hon’ble Prime Minister Mr. Narender Modi in his speech at ICAI on CA day has confirmed that scrutiny of 300,000 (Three Lakh) Companies are going on, which can be struck off u/s 248(1).

The Ministry has Issued Rules on 5th July, 2017 in relation to filing of application u/s 252(3) for restoration of name of company in the records of the MCA.

For Revival of such Struck off Companies from Registrar of Companies, Application has to be filled in National Company law Tribunal.

INSOLVENCY BANKRUPTCY CODE MATTERS

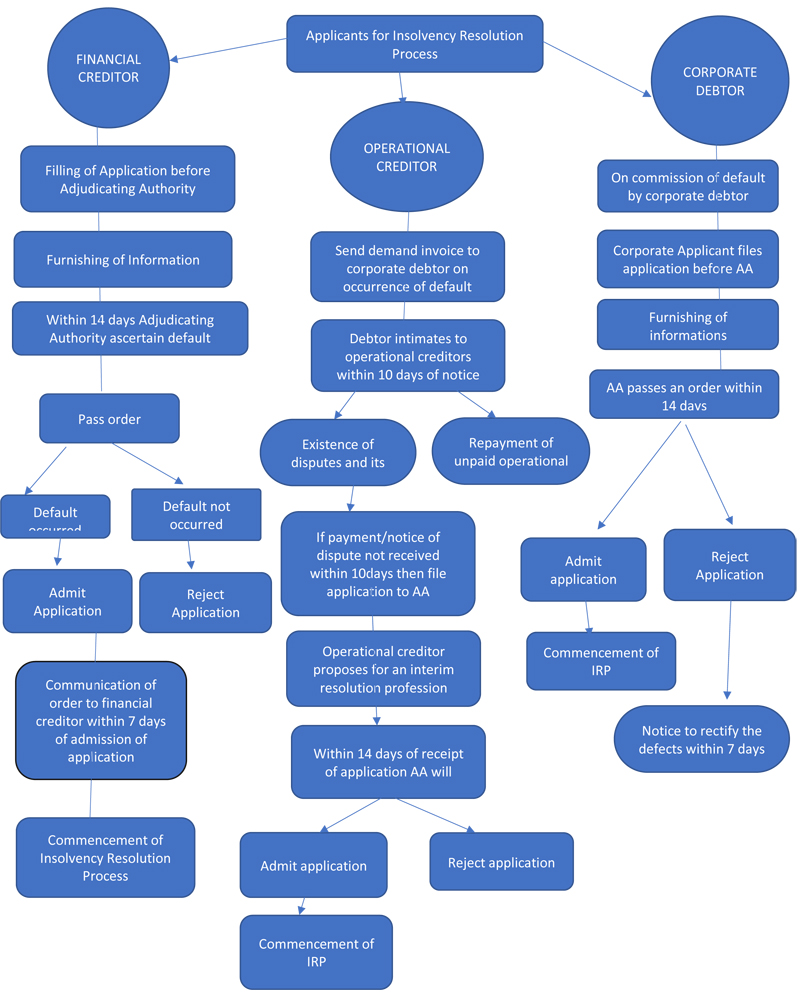

Insolvency is used for both individuals and organizations. For individuals, it is known as bankruptcy and for corporate it is called corporate insolvency. It is a situation when an individual or company are not able to pay the debt in present or near future and the value of assets held by them are less than liability.

The Insolvency and Bankruptcy Code, 2016 is one of the major economic reform Code initiated by the Government in the year 2015. Earlier there were multiple overlapping laws and adjudicating forums which cause financial failure and insolvency of companies and individuals in India. These overlapping laws create confusion among companies and Individuals. The existing laws also were not aligned with the market realties, had several problems and were inadequate. As per that legal framework, provisions relating to insolvency and bankruptcy for companies can be found in the Sick Industrial Companies (Special Provisions) Act, 1985, the Recovery of Debt Due to Banks and Financial Institutions Act, 1993, the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and the Companies Act, 2013. The Insolvency and Bankruptcy Code, 2015 was introduced in the Lok Sabha on 21st December, 2015 and referred to the Joint Committee on the Insolvency and Bankruptcy Code, 2016. The Committee had presented its recommendations in the modified Bill based on its suggestions Further, the Insolvency and Bankruptcy Code, 2016 was passed by both the Houses of Parliament and notified in May 2016.

For More Details Contact Us

We always deliver more than expected.